Empowering SMEs for a Greener Future: Business Plan Training Under the PLASTICS Project

Small and medium enterprises (SMEs) play a critical role in Sri Lanka’s transition to a circular economy. Recognising this, the EU-funded PLASTICS Project has been equipping 152 SMEs in the plastic recycling value chain with vital business skills to drive sustainability and profitability.

In collaboration with the Industrial Services Bureau (ISB), the project has successfully conducted seven intensive 5-day Business Plan Preparation Training programmes in Sri Lanka’s Western Province. These sessions, held in Gampaha, Colombo, and Kalutara districts, have already resulted in the creation of 113 detailed business plans, with eight more in progress. An additional training session is scheduled for December 2024, targeting another 15-20 SMEs.

Building a Foundation for Success

The training sessions go beyond the basics of business planning, focusing on integrating principles of sustainability and innovation into long-term strategies. The business plans incorporate:

- Vision, Mission, and Objectives to guide organisational growth.

- Marketing, Production, and Human Resource Plans to streamline operations.

- Financial Projections and Ratio Analysis for informed decision-making.

Participants were trained to include critical elements such as resource efficiency, cleaner production, green investments, and social and gender inclusion—aligning their businesses with the circular economy.

Turning Plans into Progress

The impact of these training programmes has been transformative for many SMEs:

- Structural Improvements: Participants gained practical knowledge to refine operations and enhance productivity.

- Better Financial Insights: SMEs now understand profit and loss analysis, enabling smarter investments.

- Access to Funding: Several businesses have already secured bank loans and grants by presenting their professionally crafted business plans.

These plans also provide a gateway for SMEs to access other opportunities offered by the PLASTICS Project, including:

- Green financing and RECP (Resource Efficiency and Cleaner Production) assessments.

- QEMS (Quick Environmental Management System) certification and ISO 14001 compliance.

- Participation in buyer-seller forums, fostering valuable market connections.

A Collaborative Effort

The success of these training sessions is a testament to the collaborative approach of ISB, ACTED, and the PLASTICS Project. Experienced trainers and business development experts led the sessions, supported by ACTED staff who ensured smooth logistics and organisation.

A Path Towards Sustainability

This initiative has become a turning point for many SMEs, empowering them to adopt sustainable practices, improve operations, and thrive in a competitive market. By integrating circular economy principles into their strategies, these businesses are not only reducing environmental impact but also strengthening their resilience and profitability. The PLASTICS Project remains committed to fostering sustainable SME development, one business plan at a time.

Sri Lanka’s Banking Sector: Embrace Green Finance or Fall Behind

Sri Lanka’s banking and financial sector is at a pivotal moment. With the global focus on sustainable investments, attracting green finance is now a necessity, not a choice. Professor Mohan Munasinghe, a renowned expert on sustainable development and climate finance, addressed Sri Lankan banking professionals at a seminar organised by Biodiversity Sri Lanka (BSL) under the Project PLASTICS initiative, funded by the European Union’s SWITCH-Asia programme. The event held on January 30 2025 at Jaic Hilton Colombo, aimed to help financial institutions promote a circular economy in Sri Lanka by providing them with necessary tools.

The seminar gathered 75 financial institution representatives to discuss the importance of green finance in promoting sustainable economic practices. The worldwide green finance market is growing quickly, with trillions of dollars going into projects focused on climate resilience, low-carbon, and biodiversity. For Sri Lanka’s banks to attract these funds, they must move beyond traditional lending models and embrace sustainability-aligned investment strategies.

Prof. Munasinghe’s Call to Action

Prof. Mohan Munasinghe, a Nobel Laureate and former Vice-Chair of the Intergovernmental Panel on Climate Change (IPCC), emphasised the golden opportunity for Sri Lanka’s financial institutions to adopt innovative sustainability-focused financial practices. He emphasised the need to follow global green finance standards and incorporate Environmental, Social and Governance (ESG) principles into policies to build investor confidence and stay competitive. Following frameworks such as the TCFD and TNFD can assist Sri Lankan banks in handling climate risks and appealing to global investors.

Driving Circular Innovation

Dr. Randika Jayasinghe emphasised the importance of banks in promoting the shift to a circular economy in Sri Lanka. She highlighted the need to shift from a linear to a circular economy to address climate change, biodiversity loss, and pollution. Banks can significantly influence the speed and scale of circular adoption through their investment decisions. Dr. Jayasinghe highlighted the importance of incorporating circular practices into financial strategies for sustainable financing and economic growth.

The Future of Business Sustainability

Sri Lanka is at a critical point in its economic and environmental path. As global industries adopt sustainability, the island nation needs to incorporate circular economy principles for long-term resilience. BSL’s Green Finance Specialist, Mr. Errol Abeyratne stressed the immediate importance of Sri Lanka shifting from a linear economic model to a circular one. He showed how industries can cut their carbon footprint and boost efficiency with circular business models that comply with global standards to stay competitive.

Resource Efficiency and Cleaner Production

Dr. Rajat Batra from STENUM Asia emphasised the negative effects of the linear economy on the environment and businesses, stressing the importance of transitioning to a Circular Economy and adopting Resource Efficient and Cleaner Production practices. He pointed out how wasteful resource flows in the linear economy led to environmental harm and increased business costs. Dr. Batra discussed effective methods from Europe and Asia, highlighting how industrial symbiosis and resource efficiency can lead to cost savings and environmental benefits.

The point of view of a business owner

Speaking on behalf of Small and Medium Enterprises (SMEs), Ample Clothing’s Co-Founder and Director Upekha Premathilaka highlighted the company’s commitment to sustainability and the circular economy, focusing on transforming plastic waste into biodegradable fabrics and promoting zero-waste fashion. She underscored the significant environmental impact of the fashion industry and the urgent need for sustainable practices. According to her, “Banks must evolve to support the circular economy, providing the necessary financial tools and investments to help businesses transition to sustainable models. Without this support, we risk being left behind in a rapidly changing economic landscape.”

Panel calls for a Green Financial Revolution

In closing, a highly interactive panel discussion was held with the participation of: Chief Manager SME Banking of Commercial Bank Mr Mohan Fernando; Head of Sustainability Union Bank Mr Adheesha Perera; Managing Director of Alliance Finance Mr Romani de Silva; and Group Chief Financial Officer of Aberdeen Holding Group Mr Anushka de Silva. The panel emphasised the significance of creating environmentally friendly financial products like green bonds, sustainability-linked loans, and low-carbon investment funds. These financial instruments provide a competitive edge and unlock new funding opportunities for climate-friendly businesses and projects in Sri Lanka. Supporting nature-based solutions (NbS) such as mangrove restoration and regenerative agriculture is essential due to their financial and environmental benefits.

The panel also cautioned that delaying action may cause Sri Lanka to lose billions in global climate finance. As developed nations and financial institutions focus on green investments, countries with policy misalignment risk missing out on international funding. The need to take action is emphasised by changing global regulations, like the European Union’s Carbon Border Adjustment Mechanism (CBAM).

For Sri Lanka’s financial sector to fully benefit from green finance opportunities, it must adopt a systematic and integrated approach. Strengthening collaboration between banks, government agencies, and conservation organisations is key. Financial institutions need to collaborate with policymakers to create policies that promote sustainable investments and adhere to global environmental standards.

Building Partnerships and Expertise

Establishing partnerships with global financial institutions is crucial. Several global banks and development finance institutions are looking for sustainable investment opportunities in emerging markets. Sri Lankan banks can attract long-term partnerships for economic resilience and environmental sustainability by taking proactive steps in green finance.

Building internal capacity and expertise is also essential. Financial institutions must invest in training programmes and knowledge-sharing initiatives to equip their teams with the necessary skills to assess and manage climate-related financial risks. Developing in-house expertise on green finance will allow banks to effectively structure sustainability-linked products and services while advising clients on transitioning to greener business models.

The Future of Banking

The global green finance movement is not a passing trend—it is the future of banking. Prof. Munasinghe’s insights provide a clear roadmap for Sri Lanka’s financial institutions to secure their place in this evolving landscape. With bold leadership, strategic action, and a commitment to sustainability, Sri Lanka’s banking sector can attract global green finance and position itself as a leader in Asia’s sustainable finance ecosystem. The time to act is now.

Sri Lanka can leverage frameworks like the European Union’s Circular Economy Action Plan (CEAP) and the UN’s Sustainable Development Goals (SDGs) to attract green investments and enhance global trade partnerships. However, challenges such as the lack of awareness and infrastructure to support circular economy initiatives must be addressed. Government-backed incentives and a clear regulatory framework are essential for a successful transition. To make Sri Lanka a regional sustainability leader, businesses need to use green finance, focus on sustainable sourcing, and build partnerships for circular economy principles. Policymakers should back these initiatives by enforcing sustainability regulations, providing incentives for green innovation, and promoting partnerships with international organisations.

By adopting these strategies, Sri Lanka’s banking sector can ensure its future in the global green finance landscape and support a sustainable and resilient economy.

CEOs of Financial Institutions Convene for a Strategic Briefing on Green Finance

On Tuesday, 26th November 2024, Biodiversity Sri Lanka (BSL) hosted a strategic briefing at Cinnamon Life, Colombo, under the EU-funded SWITCH Asia PLASTICS Project. This initiative, led by ACTED in partnership with BSL, ISB, STENUM Asia, and TERI, focuses on reducing plastic waste and promoting a circular economy in Sri Lanka.

The event was a major milestone, bringing together representatives from 32 organisations, including CEOs of leading financial institutions. Its aim was to explore the role of green financial services in fostering sustainable business practices and resilience within Sri Lanka’s economy.

In his opening address, Mr. Dilhan C. Fernando, Chairperson of Dilmah Ceylon Tea Company and Chairman of BSL, stressed the importance of green finance in building a resource-efficient, low-carbon economy. He stressed the need for Sri Lankan financial institutions to understand global financial flows and find innovative ways to tap into them.

Central Bank Governor, Dr. P. Nandalal Weerasinghe, provided insights into the role of the Central Bank of Sri Lanka in fostering green financial ecosystems and informed the participants that, CBSL was in the process of developing the green taxonomy and sustainable finance roadmap. He underscored the urgency of transitioning to green finance given Sri Lanka’s environmental vulnerabilities and escalating global challenges.

The programme highlighted the European Union’s Global Gateway strategy, which aligns economic growth with sustainability goals by leveraging green financial tools. Dr. Johann Hesse, Head of Cooperation at the EU Delegation to Sri Lanka, further emphasised the EU’s commitment to a green economic recovery, focusing on mobilising resources for transformative sustainable initiatives.

Co-founder/Director, Centre for a Smart Future

Mr. Anushka Wijesinha presented findings from the 2024 Green Finance Maturity Assessment (GFMA), outlining key opportunities and gaps in Sri Lanka’s financial sector to advance green initiatives. A key finding from the GFMA is that while green finance opportunities are growing – including funding lines for financial institutions and new lending opportunities for green projects – there remains a lack of comprehensive understanding within the market. Many financial institutions are unsure about their relative performance or where they stand in adopting green finance compared to industry benchmarks. This highlights an urgent need for capacity building and awareness among financial institutions, enabling them to better position themselves to leverage emerging opportunities and contribute to sustainable economic development.

The PLASTICS Project’s Green Finance component focuses on improving access to funding for SMEs to drive circular economy initiatives. BSL’s Green Finance Specialist, Mr Errol Abeyratne, noted, “Green finance is crucial for a sustainable future, but gaps in knowledge and reporting frameworks hinder progress.” The project addresses these barriers through initiatives like a digital toolkit and a practitioners’ forum, empowering businesses and financial institutions to embrace sustainability.

The event concluded with engaging discussions on actionable strategies to promote green financial solutions, empowering institutions to lead in sustainable economic transformation. This strategic briefing reinforced the PLASTICS Project’s role in driving private sector engagement and advancing circular economy principles as key enablers for environmental stewardship.

Boosting Sri Lanka’s Circular Conversion: The PLASTICS Project

Biodiversity Sri Lanka (BSL) is playing a pivotal role through the PLASTICS project, an ambitious, multi-partner initiative aimed at promoting a sustainable and circular economy for plastics in Sri Lanka. Funded by the EU’s SWITCH-Asia program, this 48-month project is designed to boost economic development in the plastics value and supply chains (V/SC) by supporting Small and Medium Enterprises (SMEs) through innovative approaches to resource efficiency, green finance, and sustainable waste management.

The overall objective of the project is to facilitate sustainable and innovative plastic minimisation and management in Sri Lanka by integrating SMEs in greener value and supply chains, thereby contributing to economic prosperity and environmental sustainability.

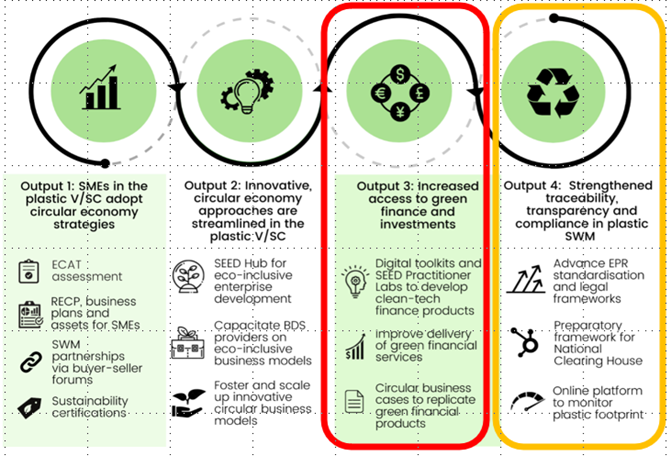

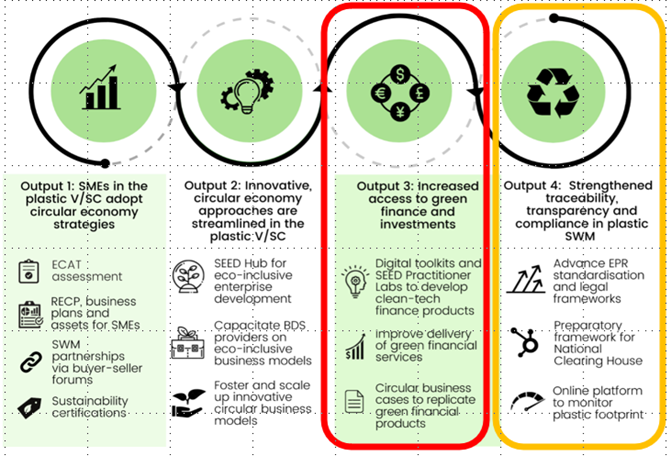

The four main outputs of the PLASTICS project are:

BSL’s Key Goals are Activity 3 and Activity 4.

Activity 3: Access to green finance and Investment’s dimension are increased to scale up green economic initiatives, especially among Businesses

Activity 4: The traceability, transparency, and compliance in plastic SWM are strengthened through public-private dialogue, collaboration and monitoring

A Focus on SMEs and Green Finance

The project aims to engage 150 SMEs, 10 entrepreneurs, and 50 Business Development Service providers to foster a collaborative environment for green business development. BSL’s work under Activity 3 involves engaging the SMEs in the circular economy, and creating awareness of green financing options. These awareness sessions, held in Colombo, Gampaha, and Kalutara in August and September 2024, encouraged SMEs to rethink their business models, adopting more sustainable and resilient approaches that align with circular economy principles.

Event held for SMEs in Colombo at the BMICH on 15 August 2024

Event held for SMEs in Kaluthara at the Royal Oshin hotel on 12 September 2024

Event held for SMEs in Gampaha at the KayJay hotel on 13 September 2024

Why promote a Circular Economy?

A circular economy promotes efficient use of resources, reducing waste by encouraging the reuse and recycling of materials. For businesses, especially in sectors that use plastics, adopting circular economy practices means less dependency on raw materials, cost savings, and compliance with evolving environmental regulations. Climate change is also a significant business risk, and understanding how to mitigate its impacts—while taking advantage of green finance options—can help businesses remain competitive in an increasingly eco-conscious market.

BSL is at the forefront of helping SMEs in Sri Lanka navigate these challenges, providing valuable insights into the circular economy and green financing incentives. These efforts are particularly focused on women-led businesses, helping them improve their competitiveness, expand their value addition, and access resources for scaling up sustainable practices.

Extended Producer Responsibility (EPR)

Another vital aspect of BSL’s contribution is through Activity 4, which focuses on advancing Extended Producer Responsibility (EPR) in Sri Lanka. EPR shifts the responsibility for post-consumer plastic waste management onto producers, ensuring they play a key role in the entire lifecycle of their products—from production to disposal. This strategy encourages responsible manufacturing and supports the proper collection and recycling of plastics.

In August 2024, BSL co-hosted the EPR Symposium in collaboration with the Ceylon Chamber of Commerce, bringing together industry leaders, policymakers, and environmental advocates to discuss how innovation can help advance environmental responsibility. The symposium was a unique opportunity to celebrate the progress made in promoting EPR in Sri Lanka, and to explore new frontiers in sustainable plastic management. By focusing on collaboration and innovation, BSL is helping Sri Lankan businesses take ownership of their environmental impact, ensuring that sustainability becomes a core part of their business strategies.

Looking Forward

With continued support from BSL and its partners, the PLASTICS project is paving the way for a sustainable future for Sri Lanka’s plastics industry. By promoting circular economy principles, facilitating access to green finance, and strengthening waste management frameworks, the project is helping businesses – both large and small – contribute to environmental conservation while improving their own resilience and competitiveness.

Through initiatives like the LIFE Series of projects and active collaboration with government agencies, BSL is ensuring that the private sector remains a powerful force for positive change in Sri Lanka’s journey towards sustainability.

Keep an eye on our newsletter for more updates on this transformative project, and find out how you can get involved in shaping a greener, more sustainable future for Sri Lanka.

EPR Symposium: A Path to Circular Economy

The Extended Producer Responsibility (EPR) Symposium held on 22 August 2024 was a pivotal moment in Sri Lanka’s ongoing journey toward sustainable waste management. Organised by the Ceylon Chamber of Commerce (CCC) and Biodiversity Sri Lanka (BSL), the event brought together industry leaders, policymakers, and environmental advocates to explore innovative solutions for plastic waste. With the support of the EU SWITCH-Asia PLASTICS project, this symposium underscored the urgent need for collective action in addressing the growing plastic pollution crisis.

EPR is a policy tool designed to make producers accountable for the end-of-life impact of their products. This means they are responsible for ensuring proper collection, recycling, or disposal, encouraging sustainable product design from the outset. In Sri Lanka, EPR has gained momentum since the launch of the EPR Roadmap in 2020, a framework aimed at reducing plastic waste by integrating circular economy principles.

Key Takeaways from the Symposium

The symposium was structured into four sessions, each focused on a different aspect of EPR’s role in transforming Sri Lanka’s environmental landscape:

- Transforming Sri Lanka’s Private Sector towards Sustainable Practices:

This session featured regional case studies from countries like South Africa and India, which have successfully implemented EPR. South Africa’s producer-led packaging agreements, for example, have demonstrated the effectiveness of private sector-driven waste management initiatives. Similar models could be adapted to Sri Lanka’s context, promoting greater accountability and collaboration among businesses.

- Accelerating Circular Economy and Green Finance:

A dynamic panel discussion highlighted the crucial role of green financing in driving the adoption of EPR. By leveraging financial incentives and regulatory frameworks, Sri Lanka can accelerate the transition to a circular economy where materials like PET and HIPS plastics are not only collected but also recycled and reintegrated into the production cycle.

- Transitioning to a Low-Carbon Economy through Plastic Management:

Industry leaders shared insights on innovative plastic management strategies that reduce carbon emissions while ensuring efficient recycling processes. A case in point was the digital Deposit Refund System (DRS) discussed in collaboration with local stakeholders, which involves QR code-tagged PET bottles that consumers can return for a refund, encouraging responsible disposal and recycling.

- The Future of EPR in Sri Lanka:

The final session took a deep dive into the evolving landscape of EPR. Discussions centered on Sri Lanka’s voluntary EPR model, which is set to mandate reporting and collection targets for producers. As PET recycling grows, this model could scale to include more materials, further driving the country toward its sustainability goals.

A Collaborative Path Forward

Sri Lanka’s commitment to EPR reflects a broader global trend toward extended producer responsibility as a means to reduce plastic waste. With the participation of over 90% of private sector stakeholders expressing their willingness to implement the EPR roadmap, the country is well-positioned to lead by example in the region. Collaboration among manufacturers, recyclers, and government bodies is key to ensuring that the EPR system can be successfully scaled, with the ultimate goal of reducing Sri Lanka’s environmental footprint.

The success of the voluntary EPR model so far has shown that Sri Lanka can make strides in mitigating plastic pollution. As the CCC and BSL continue to engage with the private sector, the lessons learned from countries with established EPR systems, like South Africa and India, will help guide the local implementation of this innovative model.

By embracing EPR, Sri Lanka is not only tackling plastic pollution but also moving toward a more sustainable, low-carbon future. This symposium highlighted the importance of stakeholder engagement, innovation, and accountability in ensuring that EPR continues to be a driving force for environmental stewardship in the country.